Our new NorthStandard site is now live. There will be no new content or updates added to this site. For the latest information, please visit our new site north-standard.com.

Asia Bulletin, October 2016

News & Insights 12 October 2016

The Standard Club has been doing business in the Asia-Pacific region for much of its history, and in 1997 we opened our Singapore office. Since then we have seen a steady increase in tonnage insured and our Asian team has grown...

The Standard Club has been doing business in the Asia-Pacific region for much of its history, and in 1997 we opened our Singapore office. Since then we have seen a steady increase in tonnage insured and our Asian team has grown significantly. Our members and operations in Asia are a key part of the club and a review of some of the issues and challenges facing the region is timely.

In this edition

- The Standard Syndicate Asia

- The state of the dry bulk market in Asia and the impact on P&I

- Korea in shipping and shipping in Korea

- Singapore – an international legal hub: update on the Singapore International Commercial Court (SICC)

- Piracy in South-East Asia

- Limitation of liability in India

- Cabotage in Indonesia

- The Hong Kong Competition Ordinance and the maritime industry

- STS in the Singapore OPL – Don’t!

- FPSO Round Table Seminar

Continued growth in Asia

When The Standard Club established a permanent presence in Asia almost 20 years ago, it decided not to set up a branch office. Instead, The Standard Club Asia Ltd. (Standard Asia), managed by Charles Taylor Mutual Management Asia (Pte) Limited (CTMMA), was incorporated as a subsidiary in Singapore in the heart of South-East Asia.

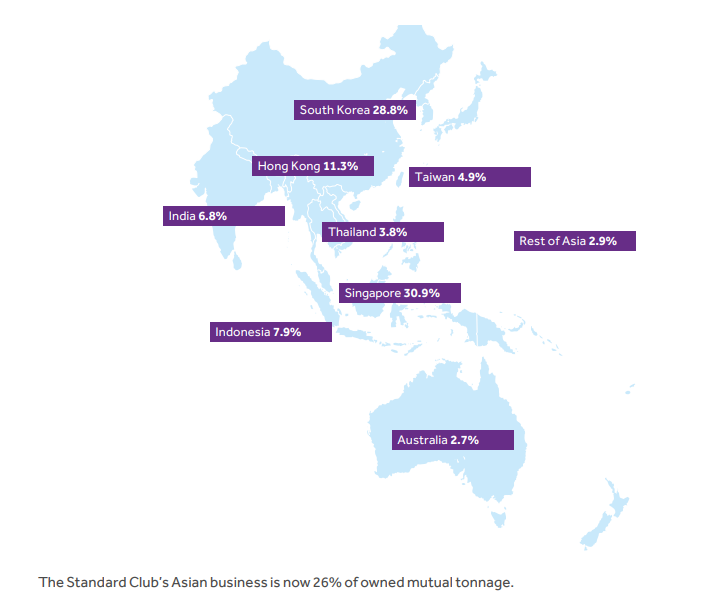

Business volumes have increased steadily since then, reflecting Asian economic expansion and our penetration into regional markets. The Standard Club’s Asian business is now 26% of owned mutual tonnage. Some of the group’s Asian business remains entered in Standard Europe for historical reasons, most notably the Japanese business through TS21 (a joint venture with Tokio Marine & Nichido Fire Insurance Co., Ltd.), although CTMMA handles the claims for these accounts. Page 3 shows a map of the club’s Asian tonnage.

Standard Asia does business in markets across the region including Singapore, South Korea, Hong Kong, Indonesia, India, Taiwan, Thailand, Australia, China and Japan, so we have a lot of ground to cover.

Today, CTMMA employs 34 people across our Singapore and Hong Kong offices. The Singapore team spans claims, underwriting, loss prevention, accounts and IT. Our Hong Kong claims office services the Greater China area. Both the Singapore and Hong Kong offices also act as P&I correspondents for members’ ships trading in the region.

In June 2015, The Standard Syndicate incorporated its Singapore service company, The Standard Syndicate Services Asia Pte. Ltd., established under the Lloyd’s Asia scheme. It employs a further two people. Read the article on page 4 of this bulletin for more information.

The future of shipping in Asia

Asian shipping has been impacted by the same factors that have affected global shipping: an oversupply of tonnage, a slowdown in world trade and lower commodity prices all combining to depress freight rates and asset values. The challenge for our Asian membership is how to survive and identify opportunities in these extremely tough market conditions.

How the club can help members meet this challenge

We will stand by our members in these difficult times as an integral part of their overall team. We are providing strong support by keeping premiums as low as we are able and by providing a proactive, pragmatic and responsive claims service that reduces members’ exposure thereby giving them a competitive edge. The fact that Standard Asia has local decision-making autonomy and a fully empowered team means we can provide fast and effective service to our members when they need it, both in their local time zones and elsewhere. We never forget that shipping is a services business and keeping clients happy through an appreciation of their needs is paramount. We also try to be adaptable. We live in a fast-changing world and need to be able to respond accordingly. When I first entered the industry in 1992, the pace of change was relatively slow and it has accelerated dramatically since then. I have no doubt it will continue to do so.

The club’s aspirations in Asia

We view Asia as a growth market with enormous potential, reflective of its fast-developing economies and the commercial dynamism of key shipping centres such as Singapore, Hong Kong and Shanghai.

Standard Asia and its shipowner board are focused on targeted regional growth, both for the club and The Standard Syndicate, in accordance with our risk appetite and business plan. We have been making good progress with seven new members so far this policy year and are seeing continued growth in our war class, the Singapore War Risks Mutual, which now has over 400 ships entered from 25 insured owners, significantly ahead of business plan forecast. Read the article on page 13 of this bulletin for more information.

Left side L to R: James Woodrow (China Navigation Co. Pte. Ltd.), Nick Taylor, Jack Marriott-Smalley, Philip Clausius (Transport Capital Pte. Ltd.), Darren Ee, Dipo Oyewole.

Top side L to R: David Roberts, SS Teo (Chairman) (Pacific International Lines (Pte.) Ltd. ), Jeremy Grose.

Right side L to R: Rod Jones (CSL Group Inc.), Nick Jelley, Bhumindr Harinsuit (Deputy Chairman) (Harinsuit Transport Co. Ltd.), Rupert Banks, David Koo (Valles Steamship Co. Ltd.), Andrew Broomhead (Pacific Basin Shipping (HK) Ltd), Ricardo Menendez (Ultraocean SA).

A centre for shipping services

Asian values centre on the importance of family, hard work and achieving your goals. Singapore is a prime example of this. In the 51 years since independence the city state has developed from relative obscurity into one of the most successful economies on the planet. Not bad for a country with no natural resources and only 278 square miles of land. It is efficient, well-run and embraces business.

It is also great to be working in a place where the maritime industry is of such importance. Singapore was founded in 1819 by Sir Stamford Raffles as a trading post of the East India Company which recognised its strategic importance. Today Singapore is a high tech, cosmopolitan, global city which has developed into a major transportation hub and one of the leading maritime centres of the world. The maritime sector comprises more than 5,000 companies who collectively contribute an impressive 7% of GDP. The focus is very much on what government can do to help, and they don’t just talk, they deliver. In the P&I space, we receive ongoing support and assistance from the Maritime and Port Authority of Singapore and the Singapore Shipping Association, in particular.

The Standard Syndicate Asia

Wei Wei Tan

Business Development Underwriter, The Standard Syndicate Asia

+65 6506 2807

weiwei.tan@syndicate1884.com

The Standard Syndicate Asia was established to provide a streamlined method for brokers and their insureds in the Asia-Pacific region to transact business with The Standard Syndicate in London.

Wei Wei Tan, The Standard Syndicate Asia’s Business Development Underwriter, shares some insights.

What is The Standard Syndicate Asia?

The Standard Syndicate Asia is a Lloyd’s coverholder, which means that we have the authority to enter into contracts of insurance on behalf of the underwriters of The Standard Syndicate. We provide access to the capacity of the syndicate in the same way that a Lloyd’s broker would do in London.

What do you do on day-to-day basis?

We create awareness of and market The Standard Syndicate to the brokers, insureds and reinsureds in the Asia-Pacific region.

We also transact and bind business with The Standard Syndicate Asia’s stamp in the following classes of business:

- Hull and Machinery

- Energy

- Cargo

- Fine Art & Specie

- Property

- Political Violence and Terrorism

- Political Risk

- Liability and E&O

- D&O

Facts

- The Standard Syndicate Asia was established on 1 June 2015.

- It is based in the new Lloyd’s Asia building in Singapore’s CapitaGreen – Lloyd’s largest underwriting hub outside of London.

- The Standard Syndicate Asia is a service company owned by Charles Taylor Managing Agency Ltd.

- Wei Wei Tan has been a broker and underwriter for over 15 years in the marine insurance industry.

Why choose The Standard Syndicate Asia?

There are several advantages to transacting business through The Standard Syndicate Asia. As we are based in Singapore, we are able to monitor and keep abreast of changes to local and regional regulatory requirements and factor these in when doing business.

By working in a similar time zone as our clients in this region, we also ensure the highest levels of service in our turnaround time when transacting business and managing claims.

Lastly, The Standard Syndicate Asia leverages its association with The Standard Club, particularly Standard Asia, which is a stone’s throw from our offices. The Standard Syndicate Asia aims to replicate the long-standing relationships fostered between the club and its members through mutual style claims management and aims to build long-term, high-contact relationships.

What issues have been faced by The Standard Syndicate Asia since its founding in 2015?

We have had a very positive first year. Being new in the market has meant people are interested in meeting us and understanding what we can provide. This is compounded by the ongoing support from members of Standard Asia.

However, building new relationships and proving that we are the right choice for assureds is a challenge which is what makes my job interesting!

What, in your view, are the main challenges faced by the shipping industry in Asia over the next three years and how well prepared are you to meet them?

Competitive pricing is certainly one of the top challenges facing the current market. Socio-economic and regulatory changes are also areas of concern – the dynamics are changing all the time. For instance, some countries in Asia, in their desire to grow their own insurance market, are proposing or have implemented changes in legislation to protect the domestic insurance market.

We have the right people on board to face these challenges, and the support and expertise of The Standard Club and the wider Charles Taylor group to draw upon when required. As such, I am confident that we are well positioned to meet the challenges of the next three years and beyond.

The state of the dry bulk market in Asia and the impact on P&I

Nick Taylor Regional

Underwriting Director

+65 6506 2859

nick.taylor@ctplc.com

2015 saw increased pressure on the dry bulk market, with a drop of average bulk carrier earnings to $7,123/day, which was the lowest level since 1999. Many speculated that the markets could not get any worse from this position, but in 2016 there has been a further softening. In this article, we look at the ways in which owners have been responding to this unprecedented situation.

A downturn in Asia bulk imports has been a contributing factor

The two key players in Asian bulk imports, China and India, have both reduced their demand and this has had a detrimental impact on seaborne trade. India’s impact is smaller, but nonetheless, the increase in domestic coal production contributed heavily to the first year-on-year reduction in bulk coal trade for over 30 years. China has had a more significant effect, and reductions in demand for coal, iron ore and steel reflect both a maturing of its economy as it moves away from reliance on heavy industry and then a partial collapse of the domestic Chinese construction market.

Key factors

The key issue for the dry bulk market is an imbalance of supply and demand. There has been a glut of new deliveries over the last seven years and, although ship demolition increased in 2015, the global dry bulk fleet still increased by 14% between 2012 and 2016. At the same time, there was a noticeable slowdown in global trade between 2010 and 2014, and the global bulk trade actually contracted in 2015 by 0.1%.

As a result, owners have been taking various measures to reduce the impact of this downturn by attempting to reduce the supply of ships.

Reduction in newbuilding orders

Newbuilding orders dropped by 30% in 2015 on a year-on-year basis and 2016 has followed suit with the lowest monthly order rates seen in over 30 years. Owners in China, South Korea, Singapore and Taiwan have all reduced orders compared to a 10-year average, although it should be noted that Japanese owners are an exception to the rule and have increased orders against the same parameter.

Lay-up

Another way owners have looked to control the supply is by idling or laying up ships. One only has to fly in or out of Singapore to see hundreds of ships lying idle in the outside port limits (OPL). Owners hoping for a short-term recovery have put them in hot lay-up, whereas those seeing no immediate turnaround in fortune have put ships into cold lay-up. The club can assist with advice for members on laying up ships and, where the right conditions are met, a return of premium can be made to the member given the reduced risk to insurers.

Scrapping

For some owners, the cost of putting ships into lay-up and then reactivating them is not offset by the value of avoiding losses, and demolition yards have been benefitting as a result. The demolition of bulk carriers increased by 87% in 2015 to 30.6m dwt and this is forecast to be surpassed in 2016 by some margin. Asian owners account for 35% of ships scrapped in 2016 so far. There are mixed feelings from a club perspective. The slowdown in fleet growth means that clubs will need to be more competitive for business when opportunities arise, but at the same time, the average age of the Asian fleet is set to reduce. In Asia, this will now be 17 years against a global fleet average age of 20 years.

Other impacts of the downturn

Financial difficulties

A different risk to owners and their clubs is that ship value reductions have led some creditors to reconsider their position in the Asian dry sector. This has affected owners in both north and south Asia, and the future remains unclear and unpleasant. For other owners and clubs there is an increase in counterparty risk, which in turn escalates trading difficulties and, for clubs specifically, may lead to an upsurge in FDD disputes.

Reduced maintenance standards

With bulk freight rates below or at the level of operating costs of vessels, even before financing is taken into account, some owners will be forced to reduce investment in their vessels. This has implications for ship maintenance and the standard of crewing. While the former may have a larger impact on H&M underwriters, P&I clubs remain vigilant for deteriorating technical standards and the clubs’ loss prevention departments have a larger role to play than ever. Perhaps more significant for clubs and owners is the reduction in crewing standards and training. This has short-term ramifications as claims can increase, especially costly navigational claims, and then a longer-term impact for owners reliant on international crew.

Outlook

Unfortunately, the slump looks set to continue. The financial uncertainty in Europe and potential political change in the USA does not help matters, even in Asia. However, some owners do see some positives and are betting that the current efforts being made to trim the bulk carrier supply will help bring the Asian bulk market back into balance by the end of 2017. This is evident from the increase in second-hand acquisitions already in 2016.

One other positive is that there is a space for new companies that are able to take advantage of low ship values and relatively low overhead costs to find ways to make small profits.

Either way, we remain hopeful that the market will indeed recover and owners can put the last eight years behind them.

The author acknowledges Clarksons Research Services Limited in respect of the market figures referred to in the preparation of this article.

Categories: Defence, Loss Prevention, Maritime Security, Offshore & Renewables