Our new NorthStandard site is now live. There will be no new content or updates added to this site. For the latest information, please visit our new site north-standard.com.

Article: A review of the impact of the Covid-19 pandemic on P&I

News & Insights 27 January 2021

This article looks back over the last year that was dominated by the COVID-19 pandemic and highlights various lessons learned.

As we look back over the last year that was dominated by the COVID-19 pandemic, it is worth reflecting on the impact the virus and its knock-on effects have had throughout the shipping industry and specifically on P&I.

For shipowners, 2020 was billed as the year in which off-spec bunker claims were to be the headline item following the introduction of the IMO 2020 fuel sulphur cap. Not only did the new eco-regulation turn out to have less impact than anticipated, but any significance it had was soon dwarfed by the explosive spread of COVID-19, the societal and economic impacts of which were very soon felt throughout the world. From a P&I perspective it has been the dominant 'new' cause of claims throughout the last year.

The club has tracked all claims throughout the year that have a COVID-19 nexus. These range from crew illness and quarantine claims directly attributable to the virus, to cargo claims and defence disputes resulting as a by-product of, say, enhanced free pratique and port state control regimes driven by the pandemic.

COVID-19 Claims Experience

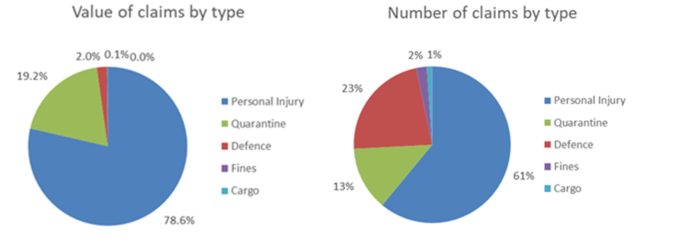

As a starting point, it is worth considering the spread of claims types handled by the club, as reflected in the below charts.

As can be seen, the experience has been largely confined to personal injury and quarantine claims under P&I cover. The club has also seen a large number of defence enquiries.

Personal injury

Personal injury (which includes illness) accounts for the significant majority of the claims that make up the club’s covid-19 record to date, both in terms of number and quantum. COVID-19, by its nature, affects people and so it is the people part of our industry that has been most affected.

Cases requiring disembarkation, repatriation and medical treatment are hardly novel when it comes to P&I, and where these relate to COVID-19 they continue to be dealt with under normal cover as with any other illness.

It is the general backdrop of COVID-19 throughout the world that has had the greater impact on P&I both in terms of difficult claims handling and costs. In particular, ports around the world have either refused or placed significant hurdles in the way of off-signing seafarers, all of which has posed a risk to the health of the crew as well as increased the costs of handling such matters. The effects of COVID-19 have not been limited to cases of the virus itself - a wide array of crew-related matters have suffered from the delay and increased regulation. Routine off-signing has had to be planned well in advance, where it is possible at all, and emergency disembarkation has been refused on numerous occasions, often despite an urgent medical need.

These issues have been recognised by all International Group (IG) P&I clubs, who have worked together at Group level. The IG has in turn coordinated efforts with a number of other industry organisations to try to find a way forward, with the ICS leading on the issue from the shipowners’ side (as this has mainly been an operational matter). The industry has sought to provide workable solutions to local governments to help effect crew changes safely and efficiently. The club was one of the initial signatories to the Neptune Declaration and will be looking at ways to support this initiative which seeks to protect seafarers from COVID-19 and facilitate crew changes.

Defence

In terms of Defence cover, we have seen numerous disputes arising as a result of the tightening of security measures across the world. Members have had to adapt to the new challenges following inadequate or unclear terms in charterparties as to who is to bear the brunt of time lost due to quarantine or crew-related delays. BIMCO has reacted with a bespoke COVID-19 clause, and we have seen specific reference to the pandemic in most charterparties executed following the initial surge of cases globally.

The club’s Defence cover has responded in numerous cases to disputes of this nature.

The Quarantine Rule

Perhaps most noteworthy, in terms of a differing experience throughout the 2020 policy year to date, is the increase in use and therefore the scrutiny that has been placed on the club’s quarantine rule. We take the opportunity to consider the rule’s usage and application here.

-

3.12 Quarantine Expenses

Expenses incurred as a direct consequence of an outbreak of infectious disease on the ship, including quarantine and disinfection expenses, and the net loss to the member in respect of fuel, insurance, wages, stores, provisions, cargo handling and port charges.

Exclusion to rule 3.12

There shall be no recovery if at the time the ship was chartered to or was under orders from the member or her managers to proceed to a port it was known, or should in the board’s view reasonably have been anticipated, that she would be quarantined.

-

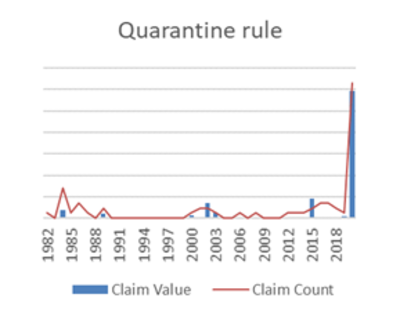

Unsurprisingly, 2020 has seen a dramatic increase in claims based on the quarantine rule. COVID-19 related quarantine claims make up around 70% of the club’s total experience of this rule since the early 1980s!

Given this uptick in quarantine-related delays and expenses under a rule that has previously seen limited use, the club produced a series of FAQs to clarify where members’ cover lies in addition to answering numerous specific queries directly with members and brokers at a case specific level. To ensure a consistent approach across the International Group, a covid-19 Working Group has been set up with all clubs cooperating to clarify the cover provided.

Broadly speaking, the rule seeks to cover any additional costs incurred due to the outbreak of an infectious disease onboard the ship. Of particular importance is the fact that an actual outbreak onboard the vessel is required to trigger the rule. 2020 has seen substantial delays where port authorities, out of an overabundance of caution, enforce 'quarantine' periods regardless of whether any actual outbreak has occurred, and club cover would not respond to such instances.

A further element that has been clarified within the club rules is the caveat to cover being provided under the quarantine rule. If it was known (or ought to have been known) at the time of chartering/commencement of voyage that the ship would be quarantined upon her arrival at the port in question, such resulting claim will become discretionary.

As for what is recoverable under the quarantine rule, a non-exhaustive list in the rules provides specifically for 'fuel, insurance, wages, stores, provisions, cargo handling and port charges' incurred during the quarantine period. Cover also extends to the costs of disinfecting / cleaning the vessel, and to additional expenses, provided they are incurred as a direct consequence of the outbreak on board the insured vessel.

Given the additional focus placed on the quarantine cover provided by the club, and an enhanced knowledge of pandemics generally that the last year has provided, the rule is currently under review to ensure that the cover can appropriately respond in the future. We understand that many of the other IG clubs are carrying out a similar review.

Deviation

In numerous cases there have been instances of port closure due to COVID-19 and the question has often been raised as to whether it is justifiable to deviate in the circumstances.

Under the Hague-Visby Rules Article IV Rule 4, a deviation will not be considered in breach of the rules where the carrier can show that such deviation was 'reasonable'. Club cover reflects this position and the Pooling Agreement provides various general examples where a deviation would be deemed reasonable.

If delivering a cargo at a specific port was rendered impossible due to a closure following an outbreak, then it presumably follows that a deviation to a nearby port could be deemed reasonable, particularly where the cargo is perishable.

The carrier may also be entitled to deviate on the basis of a liberty clause in the bill of lading (eg 'so near thereto as she may safely get') or the BIMCO clauses for 'infectious or contagious diseases' and the cargo could then be delivered to the appropriate consignee at an alternative port.

The club has also seen a number of deviations to effect a crew change for crewmembers whose contracts have expired, some of whom have had to remain on board for many months more than expected. There is a distinction to be made here with respect to deviations. A deviation might be in breach of the Hague/Hague Visby rules but nevertheless be deemed as 'reasonable' at the discretion of the club’s underwriters. Any deviation deemed as “reasonable” will not fall foul of Exclusion (2) to the club’s cargo rule 3.13 and club cover will remain in place throughout the deviation. While minor deviations for crew changes will not prejudice a member’s P&I cover, there will be instances where an owner may deviate further because of the difficulties presented by COVID-19 in relation to crew changes.

Members should always consult the club before any deviation so that the club can confirm whether cover will be prejudiced.

All sectors have felt the impact of the global pandemic in one way or another, so it is hardly surprising that there has been a significant impact on the P&I world. While the pandemic is perhaps far from over, there appears to be a shift in the significance it is having as people and businesses adapt to live alongside the new restrictions and enhanced hygiene regimes. While it appears that the peak of claims brought about by the pandemic appears to be over, it has nonetheless been useful to shine a light on how the club responds to an event of this kind, in particular with respect to the quarantine rule. Whether or not the recent mutation of the virus into its variant strains will manifest itself as a further spike in the P&I claims experience remains to be seen, but by and large we can expect a more stable response to any COVID-19-related issues going into 2021 now that the initial 'shock' of the burgeoning pandemic has worn off.

Category: COVID-19