Our new NorthStandard site is now live. There will be no new content or updates added to this site. For the latest information, please visit our new site north-standard.com.

Environment and pollution - Sulphur Emissions

News & Insights 29 June 2018

Introduction

Members will already be aware of the recent requirements relating to sulphur emissions that entered into force in emission control areas (ECAs) on 1 January 2015. Ships trading in these designated areas have to use...

Introduction

Members will already be aware of the recent requirements relating to sulphur emissions that entered into force in emission control areas (ECAs) on 1 January 2015. Ships trading in these designated areas have to use fuel on board with a sulphur content of no more than 0.10% from this date, against the limit of 1.00% in effect up until 31 December 2014.

The recent rules came into effect under the International Convention for the Prevention of Pollution from Ships (MARPOL) Annex VI (Regulations for the Prevention of Air Pollution from Ships), specifically under Regulation 14, which covers emissions of sulphur oxides (SOx) and particulate matter from ships.

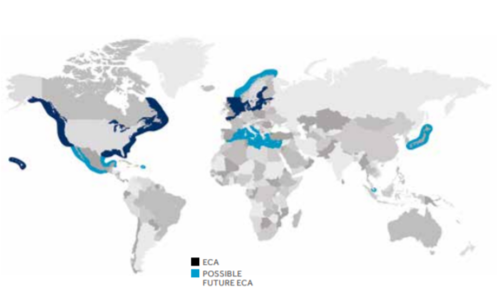

The ECAs established under MARPOL Annex VI for SOx are: the Baltic Sea area; the North Sea area; the North American area (covering designated coastal areas off the US and Canada); and the US Caribbean Sea area (around Puerto Rico and the United States Virgin Islands).

Changing to ECA-compliant fuel

Annex VI Regulation 14 provides the limit values and the means to comply with the same. Any vessel that operates both outside and inside ECAs should operate on different fuel oils in order to comply with the respective limits. This means that, before entry into the ECA, the vessel must changeover to ECA-compliant fuel oil. Similarly, changeover from using the ECA-compliant fuel oil is not to commence until after exiting the ECA.

Each vessel in this position has to carry written procedures including instructions for:

- recording the quantities of the ECA-compliant fuel oils on board;

- recording the date, time and position of the ship when either completing the changeover prior to entry or commencing changeover after exit;

- entries to be made in a logbook as prescribed by the vessel’s flag state (in the absence of such prescription, entries can be made in the vessel’s Annex I Oil Record Book).

Controls to ensure compliance

The first level of control under Regulation 14 is the actual sulphur content of the bunkered fuel oil. The value should be stated by the fuel supplier on the bunker delivery note and tested where necessary. The sulphur content will therefore be directly linked to the fuel oil quality requirements under Regulation 18, which are noted on the bunker delivery notes.

The second level of control is the ship’s crew who must ensure ECA-compliant fuel oils are kept separately and are not mixed with other oils with higher-sulphur content during transfer operations.

If this is not possible, the ship may use any equally effective “fitting, material, appliance or apparatus or other procedure, alternative fuel oil, or compliance methods”, if approved by the enforcing agency (often flag state) that is a party to MARPOL Annex VI, to ensure emissions reduction.

Annex VI Regulation 14, 5.1.1 does allow national administration to approve different means of compliance so long as they are at least as effective as the means prescribed in Regulation 14. These must be approved by the appropriate administration under IMO guidelines. Once an initial or renewal survey has taken place and compliance with Annex VI has been verified, an International Air Pollution Prevention Certificate will be awarded to every ship over 400gt. This is subject to the ship being registered under a flag state signatory to the MARPOL Convention.

Enforcement in the EU

In line with EU Sulphur Directive 2012/33/EU, member states are required to implement “effective, proportionate and dissuasive” penalties for violating the sulphur provisions. It is anticipated that in most EU member states, the violation of the Directive’s laws will result in fines. The level of these fines is currently unknown and is likely to vary between member states.

In addition, under the above-mentioned EU directive, all ships at berth in a port of any member state must use fuel with a sulphur content of 0.1% or less, even if that port is outside the Baltic Sea ECA or the North Sea ECA. Any fuel changeover operation must be completed as soon as possible after arrival at berth and as late as possible before departure.

Enforcement in the USA

On 16 January 2015, the US Environmental Protection Agency (EPA) released a penalty policy for violations of MARPOL Annex VI, in respect of ships operating in the North American and US Caribbean Sea ECAs. In the United States, the US Coast Guard (USCG) and the EPA have the authority to investigate potential MARPOL violations. If a ship is not able to comply with the new sulphur emissions limit, while transiting the North American ECA, the EPA has advised that a Fuel Oil Non-Availability Report (FONAR) must be filed.

There are several restrictions placed on the filing of a FONAR. The FONAR must be submitted to the EPA at least 96 hours before the ship enters the ECA. The FONAR must include a record of all actions taken in an attempt to achieve compliance and evidence that the ship used its ‘best efforts’ to obtain compliant fuel. Although the EPA encourages voluntary disclosures, it states that ‘the filing of a [FONAR] does not mean your ship is deemed to be in compliance...’. It should also be noted that cost is not a valid justification for not using compliant fuel.

This penalty policy applies to violations under MARPOL Annex VI. According to the EPA memorandum, the EPA may impose a civil penalty of $25,000 per violation. The duties (as per above) of burning compliant fuel, maintaining written procedures, recording the fuel changeover in the log book and retaining bunker delivery notes and samples of the fuel oil are all considered separate obligations, and thus separate violations if breached. Crucially, each day a violation continues, a separate penalty of $25,000 is levied. The policy letter sets forth the EPA’s methodology for how violations will be reviewed and evaluated, describing the agency’s plans to deter through penalties that remove the economic benefit of non-compliance and discussing the adjustment (i.e. mitigating) factors that will be taken into consideration to obtain a fair and equitable penalty. For example, the USCG and the EPA, when assessing the level of any fine or penalty, will be likely to look at the following circumstances:

- The economic benefit obtained through breach of MARPOL Annex VI;

- The gravity of the non-compliance, for actual sulphur fuel violations and record-keeping violations;

- The degree of wilfulness (or recklessness) or negligence;

- The owner or operator’s history of co-operation or non-compliance;

- The perpetrator’s ability to pay.

Aside from the civil penalties discussed above, non-compliance with the sulphur emissions standards can lead to increased inspections/ targeting by authorities, ship delays, business reputation issues and criminal penalties.

It should also be noted that the USA government will proceed against the owner, at least initially, regardless of the contractual relationship between owner and charterer. Thus, even if the charterer is responsible for arranging and purchasing bunkers under the charter, the owner may still face a liability for noncompliance under MARPOL. Such considerations should be at the forefront of an owner’s mind, especially when entering into new time-charter business.

The recent requirements relating to sulphur emissions do not, strictly speaking, alter the regulatory environment. However, the new MARPOL Annex VI provisions could well lead to disputes between owners and charterers under the relevant contractual terms concerning a number of issues, namely:

responsibility for off-spec bunkers;

how the ship should be ‘fitted for service;

who bears the cost of deviation/delays;

We look at each of these in turn.

Who is responsible for compliance?

Owners are likely to face difficulties in finding compliant low-sulphur bunkers. If such disputes arise, the allocation of liability that owners, charterers and bunker suppliers have agreed in their contractual arrangements will be key.

Absent an agreement to the contrary, under voyage charters, an owner will face the impact of increased bunker prices, as low-sulphur bunkers are (currently) significantly more expensive than higher-sulphur equivalents. For time/bareboat charters, the obligation to provide bunkers lies with the charterer, who will shoulder this financial burden. Therefore, from an owner’s perspective, it would be prudent to include an express provision in the time or bareboat charter obliging the charterer to provide sufficient quantities of low-sulphur fuel oil in order that the vessel can comply with their voyage instructions. Charterers should also bear the risk of supplied low-sulphur bunkers that do not comply with the required parameters and, ideally, an express provision should be inserted into the subject charter to deal with this. In addition, an indemnity covering all owner’s losses (including fines) that may arise from such bunkers’ supply would be beneficial, as well as a provision ensuring that the vessel remains on-hire throughout any detentions by PSC or other authorised governmental agency (such as the EPA in the United States), or any other delays incurred as a result of off-spec/ non-compliant bunkers supplied by a charterer.

Under the BIMCO Fuel Sulphur Content Clause, charterers are obliged to supply enough low-sulphur fuel to permit the vessel to comply at all times with all applicable regulations, if trade to an ECA is contemplated for that, or the vessel’s next, voyage. Orders to load non-compliant bunkers could be refused. Moreover, a charterer will be liable to indemnify, defend and hold an owner harmless in respect of any losses, delays, fines, etc. arising from any failure on their part to supply compliant fuel. The use of this BIMCO clause is encouraged by the club.

Conversely, bearing in mind that an owner could be tempted to burn the cheaper (high-sulphur) fuel for as long as possible, the charterer would need to ensure that an owner is contractually obliged to comply with all applicable regulatory regimes. A prudent charterer will also want to insert provisions in the charter to ensure that liability for complying with the system of sampling and record-keeping (bunker delivery notes) as set out in Regulation 18 of Annex VI, as well as ensuring segregation of high-sulphur and low-sulphur fuel, rests with the owner. Also, a charterer will want to ensure that any loss of time arising from such issues, i.e. detentions due to such failings, is for the owner’s account.

In addition, charterers will need to carefully review the terms of their bunker supply agreements to ensure that liability can indeed be passed back on to their suppliers, being particularly aware of the very short contractual time bars that are common in bunker supply contracts, whereas low-sulphur bunkers may not be consumed immediately. It is also crucial that fuel specifications are on back-to-back terms when the vessel is sub-time chartered.

‘Fitted for the service’

Under a typical NYPE 1946 charter, if the ship is not able to burn low-sulphur fuel in compliance with the applicable regulations, but trade to ECA ports is planned, the vessel will not be ‘in every way fitted for the service and thus will be in breach of the charter. Indeed, if the BIMCO Fuel Sulphur Content Clause for time charters has been incorporated, the owner expressly warrants that the vessel ‘shall be able to consume fuels of the required sulphur content when ordered by the Charterers to trade within any such zone’.

In light of the above, the key question is whether, and to what extent, an owner is obliged to make capital investments towards modifying a vessel (often applying approved retrofit plans) in order to make her compliant for using low-sulphur bunkers when trading in the ECAs. Until the vessel is modified, the charterer may require reduced charter rates if it cannot trade within the ECAs without incurring penalties.

Whilst this issue, amongst several others, is yet to be tested before the English courts/arbitration, it should probably be accepted that, under English law, a vessel would be contractually compliant if she can actually carry the low-sulphur fuel in dedicated/ fully segregated tanks to avoid cross-contamination risks, or else, in the absence of tanks dedicated to low-sulphur bunkers, tanks having previously consumed high-sulphur fuel have been extensively cleaned prior to receiving low-sulphur bunkers. In any case, it would seem to be irrelevant if the vessel has limited tank capacity and thus would need to carry out repeated bunkering operations whilst being in an ECA.

Besides, equipment modifications and tank cleaning actually mean increased time and costs, which an owner/charterer would need to allocate in the charter using clear language.

Deviation/delays

If a vessel’s trading pattern includes ECA port calls, this may result in regular bunkering deviations and delays, especially if there is limited capacity for storing ECA-compliant fuel. Typically, under a charter, the vessel will be obliged to proceed with the ‘utmost despatch’ from port to port, or other nominated destination, without deviations, i.e. by the direct route or by a route that, though not direct, would be a usual and reasonable route. A failure to do so may constitute a deviation, which can have an impact on a member’s P&I cover in circumstances where such deviation would prejudice a member’s rights and defences under the Hague/Hague-Visby Rules. Therefore, from an owner’s perspective, inserting a suitable liberty to deviate for low-sulphur fuel stemmings would be strongly recommended.

On the other hand, an owner should very cautiously consider a charterer’s voyage orders, which could possibly constitute a breach of the contract of carriage, especially if the suggested route could potentially create safety issues for the vessel.

Bearing in mind that disputes and conflicts in relation to the recent MARPOL VI requirements are likely to escalate until the situation is crystalised, owners and charterers are recommended to invest in loss prevention, not only by taking all the appropriate practical/ technical steps, but also by focusing on their contractual arrangements, aiming to explicitly allocate all costs and risks, thus minimising the scope for any disputes that might otherwise have arisen due to ambiguity.

Establishment of Emission Control Areas in China

On 4 December 2015, the Chinese Ministry of Transportation published new regulations designating parts of its coastal waters as emission control areas (ECAs). Due to the growing recognition of how shipping contributes to air pollution along the coast, ships, including ocean-going vessels, which operate in the three ECAs near the Pearl River Delta, Yangtze River Delta and the Bohai Sea will be obliged to use fuel containing less than 0.5% sulphur from 1 January 2019.

Eleven key ports within the designated areas are allowed to apply the same requirement to ships at berth as of 1 January 2016. These eleven harbours are Shanghai, Ningbo-Zhoushan, Suzhou, Nantong (Yangtze River Delta ECA), Shenzhen, Guangzhou, Zhuhai (Pearl River Delta ECA), Tianjin, Qinhuangdao, Tangshan and Huanghua (Bohai Sea ECA).

From 1 January 2017, the requirement will become mandatory for all ports within the designated areas, including the eleven mentioned above.

At the end of 2019, the Chinese government will assess the situation and consider whether it is necessary to reduce the sulphur limit to 0.1%. It is our understanding that this decision will take into account the supply capabilities of the Chinese refinery industry and bunker providers.

Under the China’s ECA regulation, alternative methods of compliance will be permitted, such as the use of shore power, using clean energy, or exhaust gas scrubbers.

It should be noted that despite the use of the term ‘ECA’ with regard to this regulation, it is not linked to the MARPOL ECA requirements described above; it is strictly a Chinese regulation. The practical implication of this is that the IMO’s ECA rules provide no formal guidance as to how the Chinese authorities will implement and enforce their own requirements.

Timeline

1 April 2016: Ships berthing at key ports in the Yangtze River Delta ECA to use fuel ≤ 0.5% sulphur content

1 October 2016: Ships berthing at Shenzhen port in the Pearl River Delta ECA to use fuel ≤ 0.5% sulphur content

1 January 2017: Ships berthing at KEY ports in ECAs to use fuel ≤ 0.5% sulphur content

1 January 2018: Ships berthing at ALL ports in ECAs to use fuel ≤ 0.5% sulphur content

1 January 2019: Ships operating anywhere in ECAs to use fuel ≤ 0.5% sulphur content

Localised regimes

In addition, a number of other more localised low sulphur regimes are in force in various jurisdictions, and members should be aware of the rules and regulations applicable in those countries to which they trade. Some of these other low sulphur regimes are as follows:

California

Californian waters fall within the North American ECA designated under MARPOL Annex VI. However, California also applies its own low sulphur fuel regulations. As such, ships operating in Californian waters (and within 24 nautical miles of the Californian coastal baseline) need to comply with not only the ECA regulations but also with the Californian regime. Whilst the ECA regulation only requires fuel used on board to meet the 0.1% maximum sulphur limit, the Californian rules dictate that fuel used on board must also be marine distillate fuel (either marine gas oil (MGO) or marine diesel oil (MDO)).

Turkey

All ships at berth in Turkish ports and all inland waterway craft sailing on Turkish inland waters are required to burn marine fuel with a sulphur content not exceeding 0.1%. Passenger ships providing regular passenger services are required to use marine fuels with a sulphur content not exceeding 1.5% whilst in Turkish waters.

Hong Kong

Ships of 500gt and above calling at Hong Kong must use marine fuel with a sulphur limit of 0.5% whilst at berth, other than during the first hour after arrival and the last hour before departure.

Australia

All cruise ships are currently required to use marine fuel with a sulphur content of 0.1% or less whilst within Sydney Harbour. From 1 July 2016, this requirement was extended beyond the period at berth to the whole period in which the cruise ship is within Sydney Harbour.

What’s next on sulphur emissions? Implementation of a global cap

The 70th session of the IMO Marine Environment Protection Committee (MEPC 70) was held in October 2016. MEPC 70 decided that 1 January 2020 will be the enforcement date of the global sulphur cap of 0.5% for maritime fuels (from the current maximum of 3.5%). IMO’s decision, which will undoubtedly have profound implications for the economics of shipping, has focused on the availability of compliant fuel, rather than taking into account the purchase price (the cost of compliant low sulphur fuel is likely to be well over 50% more than the cost of residual fuel). While it is likely that oil refiners will be unable to supply sufficient quantities of 0.5% fuel produced especially for marine use before 2020, it seems likely that other more expensive fuels, such as 0.1% sulphur distillate, would be available, although this may well have a negative impact on the supply of diesel for shore based industries.

The European Union has already agreed that the 0.5% sulphur requirement will apply in 2020 within 200 nautical miles (370 km) of EU member states’ coasts. In theory, if the IMO global cap was postponed this would create a narrow corridor along the coast of North Africa in which the use of cheaper fuel would still be acceptable, while elsewhere in the Mediterranean it would not, a situation which EU member states at IMO might have found difficult to accept.

In light of IMO’s decision, ship operators and oil refiners will have to start preparing for implementation without delay. The oil refining industry will need to take important decisions to ensure that sufficient quantities of compliant fuel will be available. Ship operators will need to take important decisions about whether to invest in alternative compliance mechanisms such as exhaust gas cleaning systems (scrubbers) or the use of low sulphur fuels such as LNG. The implementation of the 0.5% sulphur cap may also affect decisions on whether or not ships will be sent for early recycling.

Contrary to the fears of some, there is little evidence of deliberate non-compliance by ship operators since the initial implementation of the sulphur ECAs in January 2015, although occasionally there have been some technical problems associated with the fuel switchover or the specification of fuels provided by some bunker suppliers. Nevertheless, the sound implementation of a worldwide sulphur cap will present a much more complex challenge than the ECA requirements, so it is vital for IMO member states to start addressing issues associated with compliance and enforcement as soon as possible in order to ensure fair competition and the maintenance of a level playing field.

The information and commentary herein are not intended to amount to legal or technical advice to any person in general or about a specific case. Every effort is made to make them accurate and up to date. However, no responsibility is assumed for their accuracy nor for the views or opinions expressed, nor for any consequence of or reliance on them. You are advised to seek specific legal or technical advice from your usual advisers about any specific matter.